I want you to imagine a future world with me. This future world isn’t governed by fiat money (government issued currency that isn’t backed by a commodity such as gold). It’s governed by a new form of money; It’s governed by decentralized currency, namely, Bitcoin.

In this hypothetical world everything flips on its head from the current situation. Many things change, but the most important thing is that instead of the global monetary supply being run on the dollar it is run on the Sat (.00000001 BTC).

In the minds of many Bitcoiners, this world isn’t just likely, it’s inevitable.

Embed from Getty ImagesPersonally, I do not think it is inevitable but I do think the probability of this world coming to fruition within the next thirty years or so is higher than non-Bitcoiners think. I don’t know a person who would define themselves, on some level, as a Bitcoiner who doesn’t think that Bitcoin will become more valuable than gold. Currently, gold has a market cap of about $10 trillion dollars or about 10x the current price of Bitcoin. If we can see that return in less than five years, that’s a fantastic return. But it’s a return that would still be measured in fiat.

But what if the most bullish Bitcoiners are right? What if Bitcoin not only eats into gold’s market cap but other assets that are used as a store of value as well? Here is a list of such assets:

| Asset | Market Cap |

| Gold | $10 Trillion |

| Real Estate | $200 Trillion |

| Bonds | $100 Trillion |

| Equities | $30 Trillion |

| Broad Money | $100 Trillion |

| Fine Art/collectibles | $20 Trillion |

Let’s go through them. Gold is a commodity that is primarily used as a store of value. Some of the value comes from its uses in the real world but most of it is just that people have faith it will hold its real buying power[1] over time. As discussed earlier, it’s fully expected that Bitcoin will eat into gold’s market cap because it’s simply better at being a monetary store of value than gold.

With real estate, some people buy it to live in but they are often used as a way to safely store value. In this case think of someone who owns more than one home or a Chinese billionaire who buys a house in America so that the Chinese government can’t seize all of his wealth. In Florida, because of the way Florida’s constitution is written, buying a larger home than you need is a way to protect some of your wealth from bankruptcy. In many cases, Bitcoin could be seen as a more attractive way to store value than real estate because it’s more portable, it’s harder to seize, and it is far more liquid. So it’s reasonable to assume Bitcoin will eat into the real estate market cap.

Right now, with bonds, some bonds are not just yielding negative real rates but negative nominal rates too. Bitcoin will certainly eat into the bond market as people want to ensure they, at a minimum, don’t have less real buying power in the future.

Right now, many companies that aren’t making any actual profit are highly valued. As equities get reassessed, it’s hard to believe that Bitcoin doesn’t eat into some of the equity market as well. Especially if Bitcoin continues to outperform equities when measured in fiat.

Every country is debasing their money supply with excessive printing. As the price of all of these other assets keep skyrocketing, it’s hard to believe more people don’t flee to a safer currency, namely Bitcoin. We are already seeing this en masse in certain countries that have debased their currency to near worthless levels. This trend will only continue.

For the purposes of beauty and emotional attachment, Bitcoin can’t compete with art or collectibles. At least not really. (Though I do love my Bitcoin!) But if someone was using fine art and collectibles merely as a way to store wealth, which many high net worth individuals do, then Bitcoin is far superior for the reason that it’s much easier to transport, harder to seize, and far more liquid. Bitcoin should eat into this market some as well.

Let’s say Bitcoin takes 20-25% of this total market. That’s $92-$115 Trillion in market cap. That seems plausible. At that level, it’s hard to see how Bitcoin doesn’t become a world’s reserve currency on the current level of the dollar and it would become if not the foundation of the global monetary world, at least, one of them.

If you knew for sure that world was coming to fruition in the next thirty years but you weren’t sure when, wouldn’t you think owning Bitcoin would be important to you having a significant place at the global monetary table?

Well, right now, Bitcoin’s market cap is hanging out at about $1 trillion in market cap, a 100x discount from that hypothetical future.

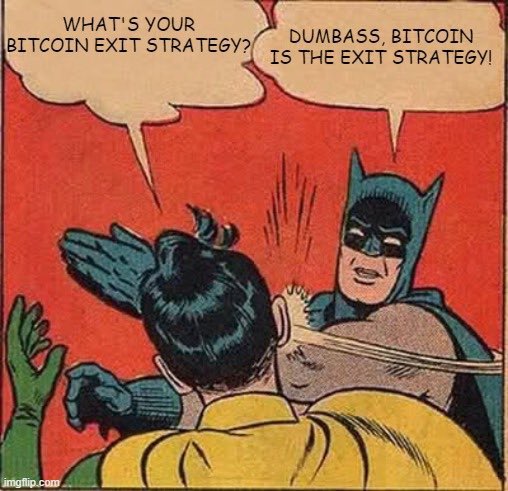

And if you knew this world was going to come to fruition, wouldn’t you be much less apt to sell your Bitcoin for any reason except to obtain an asset that would, at a minimum, have a high probability of retaining its real world buying power?

This is the $100 Trillion mistake I see many people making.

Many people are convinced the world will keep running on fiat and, as a result, either don’t own any Bitcoin or, if they do, they consider Bitcoin merely an investment and they discuss selling it for things like a vacation or a depreciating asset like a car.

Personally, I’m going to avoid making this mistake until I’m reasonably confident this future hypothetical world will not come to fruition. And I’m just not there yet.

[1] Real buying power is how much the money can buy in goods, services, or assets in the future regardless of the price in money. Nominal value is the price measured in money terms. Something can have gone up in nominal value, meaning you get more fiat money for it but down in real terms, meaning that you can buy less goods, services, or assets with it (inflation).