On the obtainability of Bitcoin, Picassos, Nathan C. Perry paintings, and the relative value of them all. Or, alternatively, Bitcoin is water.

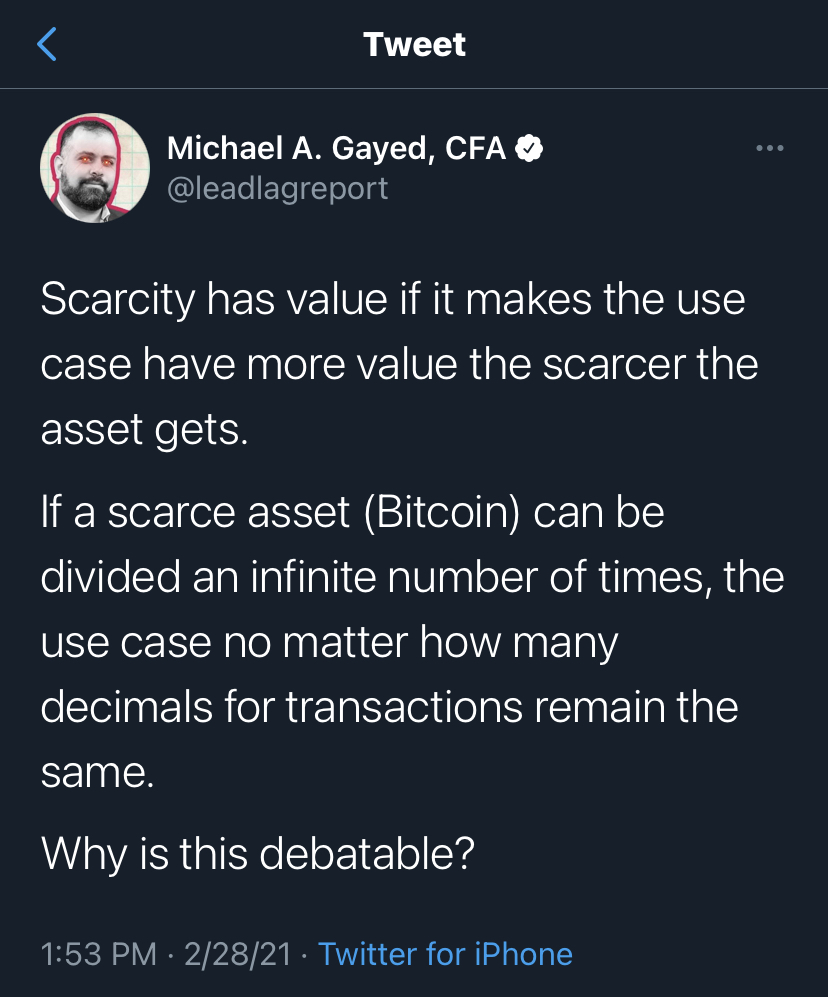

A hot topic that never ceases to stop on Bitcoin Twitter is the relative scarcity or abundance of Bitcoin. Bitcoin supporters say that Bitcoin is scarce and that’s why it’s valuable. Bitcoin critics point out that because of both its current divisibility into one Sat (.00000001 Bitcoin) and the fact you can divide it further if you updated the protocol, it is, in fact, not scarce. Most Bitcoiners then just respond with “Can’t you do fractions!”

I want to take this point seriously and try to address it because it seems to be an endless, never ending loop and I think if we think about it deeply, we can lay the issue to rest to the satisfaction of both parties.

First, I will just say that I think this argument is largely a semantic one. It’s being driven by the fact that “scarce” is probably not the best word to use here.

The fact is Bitcoin is not scarce in the way some things are. Picassos are very scarce and, his masterpieces even scarcer, and that’s certainly part of the reason they are valuable.

Although, scarcity alone is not sufficient for anything to be valuable. There are some Nathan C. Perry paintings but, trust me, you don’t want one and, if you owned one, would probably pay someone to take it away if you were for some reason forbidden to throw it out.

Furthermore, Picassos don’t come to market that often. They are very hard to obtain even if you could afford to buy one.

Lastly, obviously, Picassos are not divisible at all. If you divide one, it loses its value. Picassos would make utterly terrible money.

On the other hand, Bitcoin is easy to obtain, especially a part of one. Bitcoin is not scarce in the same way that Picassos are . If you want to own even part of one, you can easily do that.

What it is meant by Bitcoin is scarce is more that Bitcoin’s final denominator is fixed, and the rate of issuance of new Bitcoin until we reach that final denominator is fixed too. As more Bitcoin is pulled off the market and put into cold storage, it is getting ever more expensive to acquire Bitcoin, especially meaningful amounts.

The fact is you do not want money to be truly hard to obtain, especially money that is engineered to reach reserve currency status. If large swaths of the global population couldn’t obtain any Bitcoin, it would never be able to achieve that status.

In fact, this is one of the drivers of tension in United States monetary policy. The US Dollar is the world’s reserve currency and, it means, that many other countries need US Dollars to settle debts.

There is demand for the dollar and if the dollar is becoming less liquid, flowing through our global system less easily, then the United States government must find a way to meet this demand. This demand is being met by the United States being a net importer. We buy foreign goods from foreign companies providing them with US dollars and us with consumer goods. (The foreign importer gets something they value more, dollars, and we get something we value more, the cheap goods.) In addition, this demand is met by turning on the printing press and printing money. Basically, we turn up the tap so the money flows faster.

If you are starting to see a theme here with liquid, flow, and turning on the tap you aren’t wrong. Thinking about money, Bitcoin included, as water helps to clarify issues. We do this naturally. It’s why we talk about “cash flows”, “pools of money”, and sometimes we talk about “financial plumbing”. For some reason, people seem to do this less with Bitcoin, I think because people still think of Bitcoin in fiat terms as an investment and not money. But it IS money. If you don’t think about it in these terms, you will never fully understand it.

As a quick aside, this is all very similar to water itself which is both abundant and scarce at the same time in part because of where it’s located, what it’s used for, and who controls it.

Jumping back to Bitcoin, Satoshi had this issue. You need money to be scarce in one sense but not another. Satoshi settled on a a fixed flow rate and the ultimate total pool of Bitcoin being known to all ahead of time. This is the element of scarcity we have with regards to Bitcoin. The infinite divisibility resolves the obtainability issue.

This all makes sense if we jump into a future hypothetical world. Let’s say Bitcoin obtains reserve currency status and Bitcoin is locked into different pools of money at different sizes. You’ve got the businesses who have some, you have large institutions who have some, governments, and even individuals. Let’s now imagine that one Satoshi (.00000001 BTC) can buy the equivalent of what $1,000 can buy today. This would guarantee a world where Bitcoin is not flowing well. You’d only use it buy large purchases or have to run large tabs until you hit the value of $1,000 in goods or services. (Just think about how you’d go about trying to buy your morning coffee with some amount of Bitcoin. It wouldn’t be simple.)

But we can’t just turn on the tap like the US government does. In fact, we don’t want that to happen because that devalues the currency which was the whole issue we were trying to avoid.

So we can agree by consensus to divide Bitcoin (and thereby the Satoshi) even further in order to get the Sats flowing once again. This would prevent the currency from devaluing to those who hold it because they would have the same amount of total Bitcoin but suddenly they can buy their morning coffee without jumping through elaborate hoops

Coming back to money as water for a second, it’s as if water is slowing to a drip because of obstructions in the plumbing and instead of turning up the water pressure to get the water to flow faster and maybe even bust through some obstructions, you reduced the size of the water droplets so it can easily flow through whatever obstructions are in the plumbing.

Bitcoin is scarce because it must flow through people who value it but it’s abundant because they will give you some, even just one Sat, if you provide the people who own it something they value more than that amount of Bitcoin. And because of the ability for Bitcoin to be infinitely divided more in the future, we don’t have to worry about choosing between a world where that delicate balance that allows for flowing money is lost or devaluing the currency. We get to have our cake and eat it too.